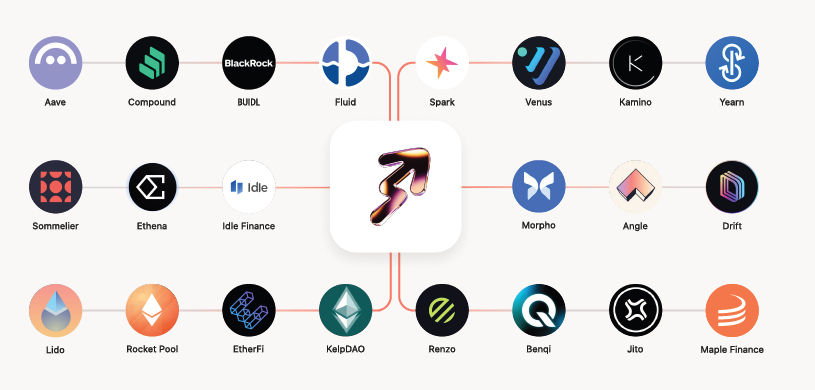

Yield.xyz is the backend infrastructure that makes Web3 yields feel like Web2 products. For fintechs, neobanks, wallets, and dapps, this means you can deliver a seamless yield experience without exposing users to blockchain complexity. Unlike direct integrations with Aave, Morpho, or other individual protocols, Yield.xyz abstracts the entire yield surface into one standardized interface and handles all the operational complexity developers would otherwise need to build and maintain themselves.

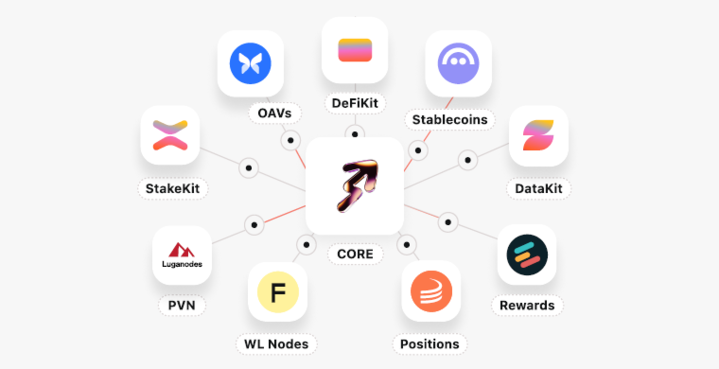

With a single API, Yield.xyz gives instant access to 1,500+ yields across 75+ networks. Instead of manually integrating and maintaining each protocol individually, clients can scale across the entire DeFi stack with minimal engineering overhead. Hundreds of new yields are added monthly, with new networks like Monad and Plasma supported within days of launch. What's more, our Optimized Allocator Vaults (OAVs) handle all the complexity: from auto-compounding and reinvesting incentive tokens to cross-chain routing, bridging, and fee accounting. Developers also gain access to Shield, which verifies user-intent and ensures users are signing the exact transactions they expect, a layer of safety that direct protocol integrations cannot provide.

In short, Yield.xyz gives any DeFi yield a Web2-quality UX — without the upkeep of maintaining dozens of bespoke protocol integrations.

What Yield.xyz Has to Offer

Our hyper-modular infrastructure is a one-stop shop, giving clients everything needed to go live in minutes, not months:

- One API to access 1,500+ strategies across 75+ networks

- A best-in-class unified metadata and reporting API

- Built-in support for compliance, reporting, and geoblocking

- Full vault infrastructure (OAVs) that abstracts away Web3 operations: reward reinvestment, token routing, fee taking, and more

Whether you start with a single Aave yield or scale to multi-strategy deployments spanning dozens of protocols, the integration stays the same. This is one of the core advantages over direct integrations: you never rebuild or maintain new logic as you expand. New protocols, new yields, and new chain deployments automatically flow through the same interface.

With Yield.xyz, you can:

- Start small, expand infinitely: no added engineering required

- Equip any DeFi yield with OAVs for multi-strategy routing and automatic off-ramping of incentive tokens

- Capture user-facing fees (deposit, management, performance) that standard protocol integrations don’t allow

- Use a single interaction standard (enter, exit, balances) across all protocols instead of building custom flows per integration

- Deposit in one token, and the API handles any swaps into the correct strategy asset

Direct Integration vs. Yield.xyz: Side-by-Side Comparison

| Feature | Direct Integrations | Yield.xyz Integration |

|---|---|---|

| API Simplicity | ❌ Requires bespoke logic per protocol | ✅ Single API across all protocols and vaults |

| Token Wrapping / Offramping | ❌ Needs external infra via third party providers — not offered by protocols | ✅ Native in OAVs (off-ramp to fiat or route to wallets) |

| Fee Handling | ❌ Custom contract logic required — not supported at the protocol level, therefore requiring custom contract development in-house | ✅ Built-in support for deposit, management, performance fees |

| Reporting & Analytics | ❌ Internal tooling required | ✅ Built-in position, history, and rewards tracking |

| Reward Auto-Conversion | ❌ Manual or third-party reliance | ✅ Auto-swaps incentives into deposit token (e.g., USDC) |

| Multi-Strategy Vaults | ❌ Requires custom orchestration logic with months of Solidity engineering overhead and audits | ✅ Natively supported by VM OAVs |

| Time to Launch | ⚠️ 4–12 weeks | ✅ <4 weeks average |

| Multiple Provider Complexity | ⚠️ Stringing together 10+ 3rd party APIs | ✅ Everything through one API, one system |

| Ownership of Deals | ✅ You own it | ✅ Still fully owned by you — no rev share on your side deals |

Scale Yield Offerings With Yield.xyz

With Yield.xyz, it’s one deployment that scales without limits. Developers don't deal with re-architecting, extra development work, or hidden revenue shares. Simply integrate once and have all of Web3 at your fingertips.

Our Optimized Allocator Vaults (OAVs) abstract away every layer of onchain complexity: off-ramping incentives, reinvesting rewards, cross-chain routing, fee accounting, and more. You simply decide which yields to offer, and everything else is handled automatically.

Most importantly, you retain 100% control over your deals and upside:

- Any direct relationships you strike with protocols remain entirely yours. We never take a cut.

- You can monetize yields through user-facing fees (deposit, management, performance), which aren’t possible with raw protocol integrations.

- Yield.xyz only charges where we create new value — at the OAV level, enabling fee capture and optimization that you wouldn’t otherwise have access to.

With Yield.xyz, scaling yield products is simple: one integration, no extra lift, and no need to rebuild your infrastructure each time you want to support a new protocol, network, or strategy.