The digital asset landscape is undergoing a seismic shift, with institutional investors leading the charge into cryptocurrencies, decentralized finance (DeFi), and tokenized assets.

In January 2025, EY-Parthenon and Coinbase surveyed 352 institutional investors globally, with respondents representing firms managing over $1 billion in assets under management (AUM). The survey reveals a robust appetite for digital assets, driven by regulatory clarity, yield opportunities, and innovative use cases reshaping the financial ecosystem.

Key Findings

Institutional Adoption at 86%

An impressive 86% of surveyed institutions have exposure to digital assets or plan to allocate resources in 2025. This marks a significant milestone in mainstream adoption, with 85% of respondents having already increased their allocations in 2024.

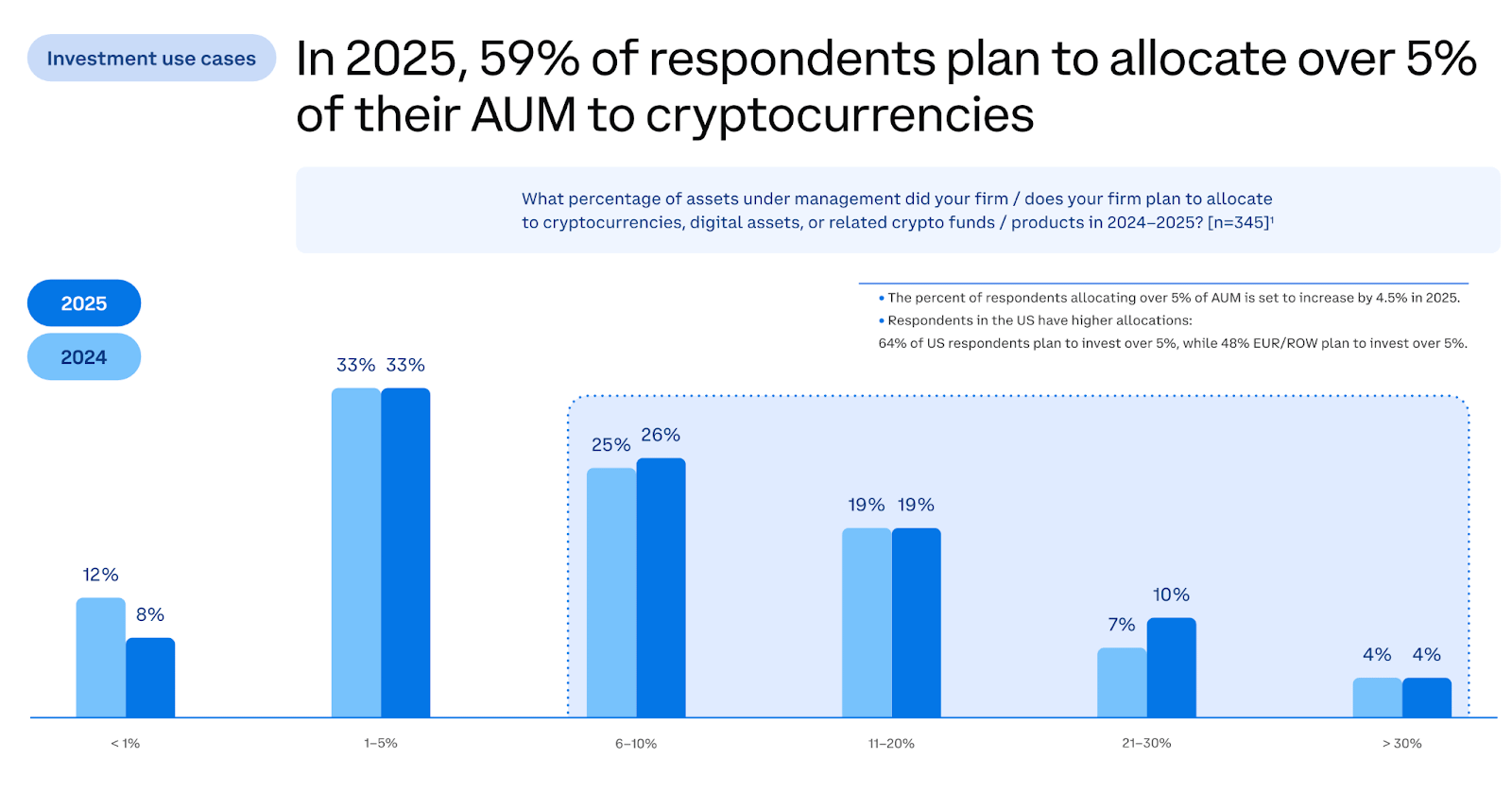

Increasing Asset Allocation

The survey highlights a pivotal trend: 59% of institutions intend to allocate over 5% of their AUM to digital assets in 2025. This growing commitment underscores investor confidence in the long-term potential of cryptocurrencies as a core portfolio component.

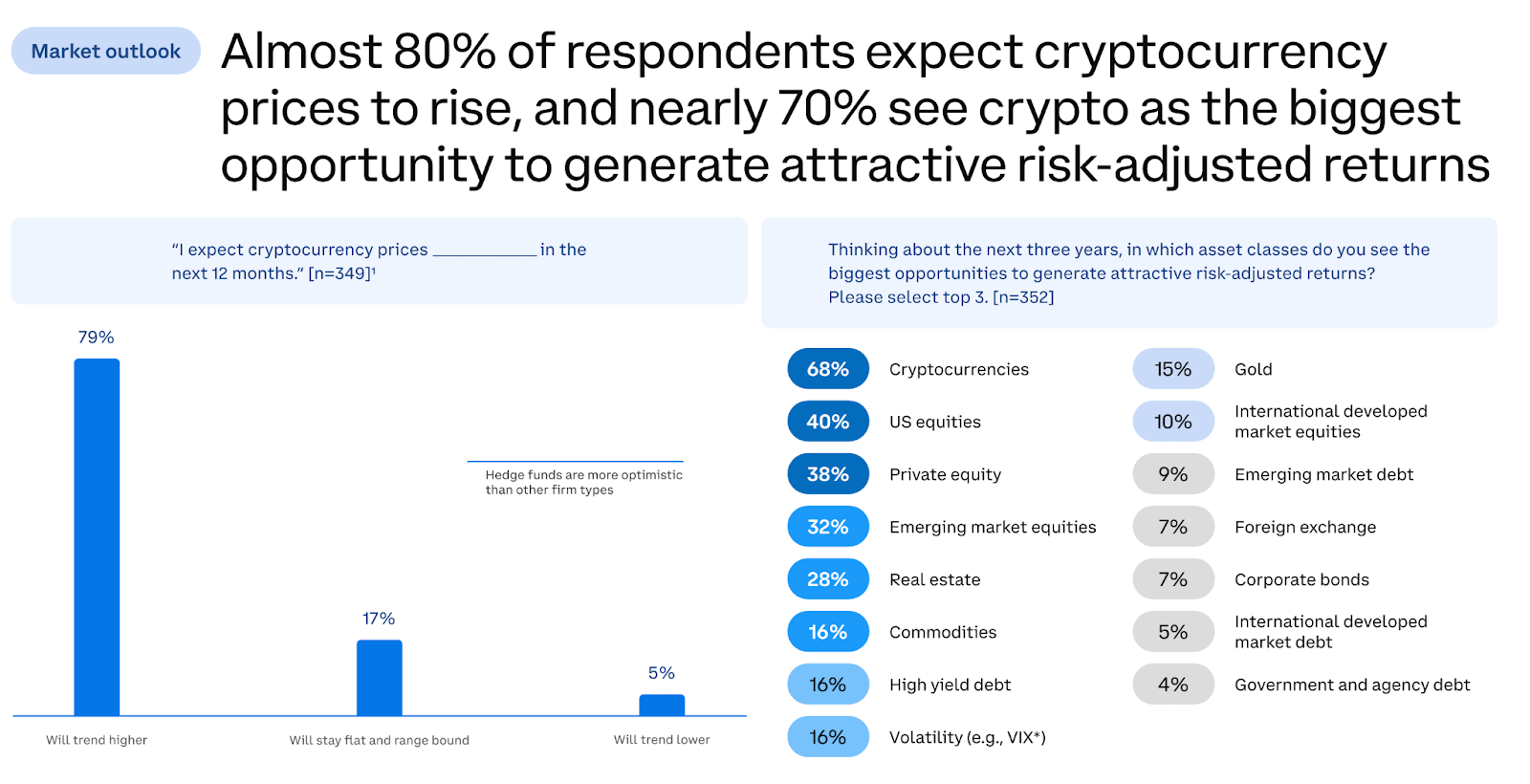

Rising Market Optimism

Investor sentiment remains bullish, with 79% expecting crypto prices to rise in the coming year. This optimism is fueled by clearer regulations and innovative applications that are enhancing transaction efficiency and expanding use cases across industries.

Yield Generation as a Key Driver

Yield generation is emerging as a major draw for institutional investors. Approximately 35% cite staking rewards and stablecoin interest as primary motivators for entering the crypto space. With traditional yields lagging behind, on-chain yield opportunities are becoming increasingly attractive.

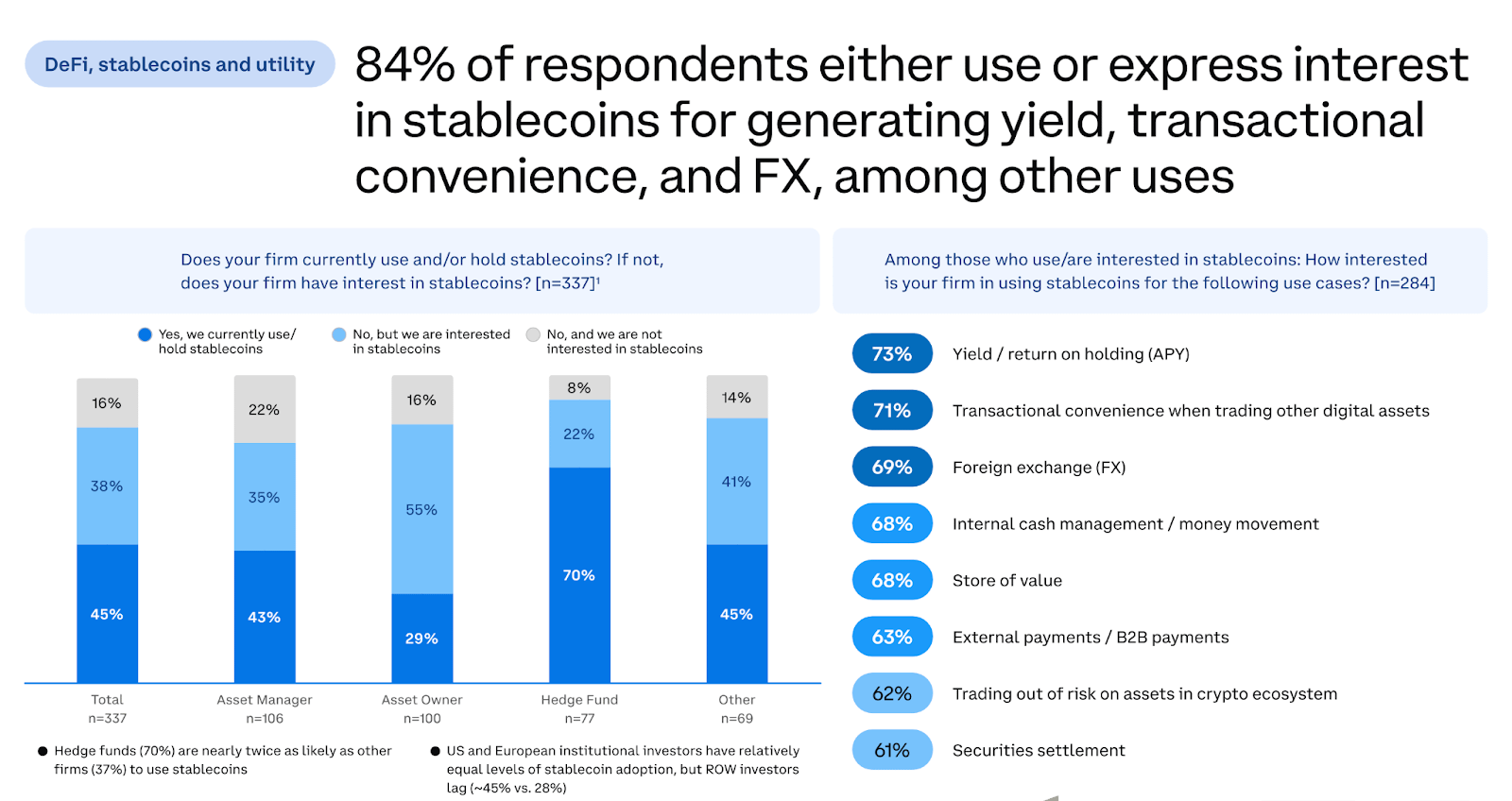

Stablecoin Strategy

Stablecoins are gaining widespread traction, with nearly half of institutions leveraging them for yield generation, settlement, or foreign exchange purposes. Furthermore, 84% either already integrate stablecoins or plan to do so in the near future. This trend positions stablecoins as a cornerstone for DeFi yield platforms.

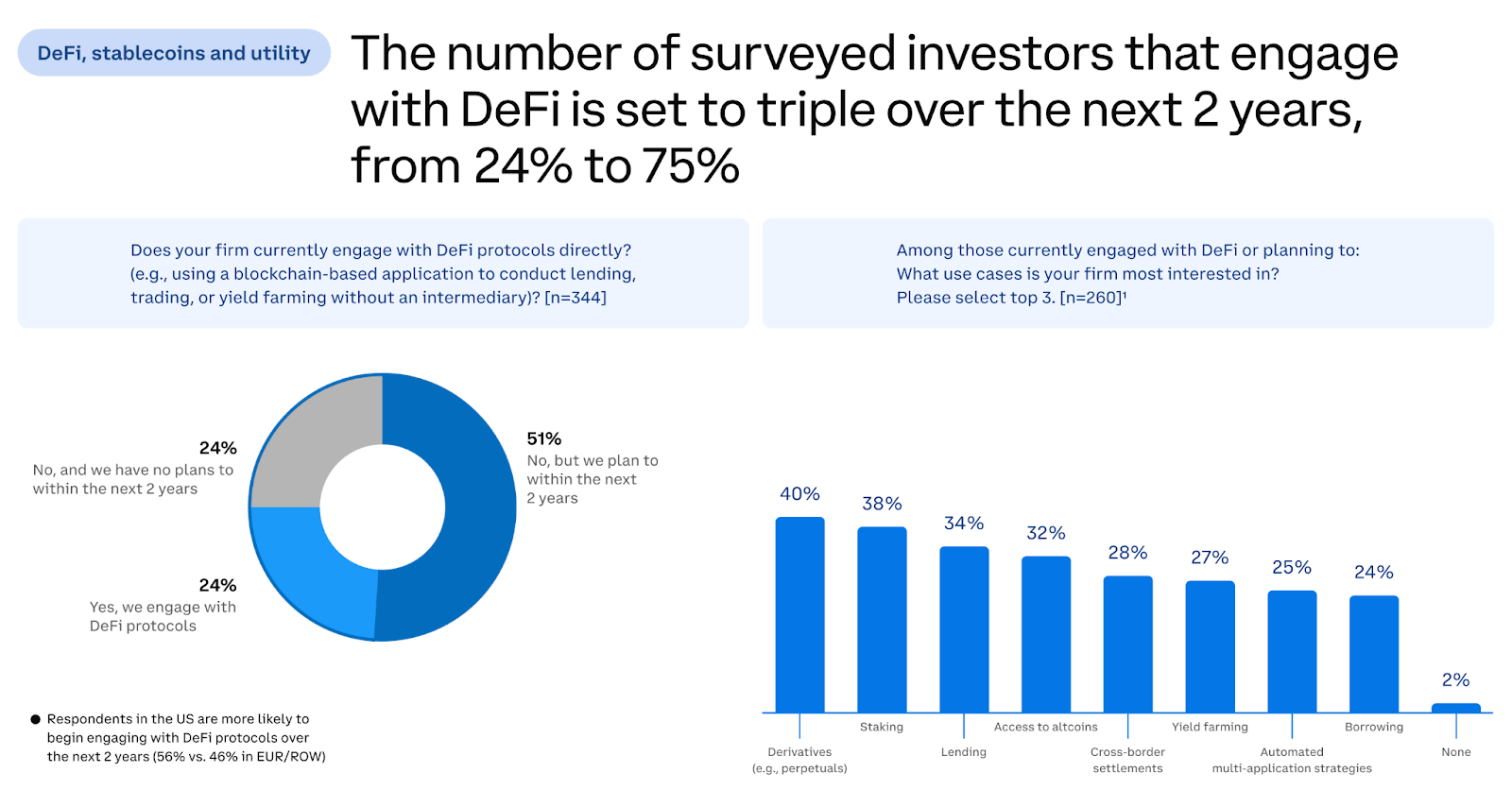

DeFi Transformation

Institutional engagement with DeFi is set to triple—from 24% currently to an estimated 75% within two years. As compliance hurdles ease and technology advances, institutions are expected to drive growth in lending, staking, and liquidity provision within DeFi ecosystems.

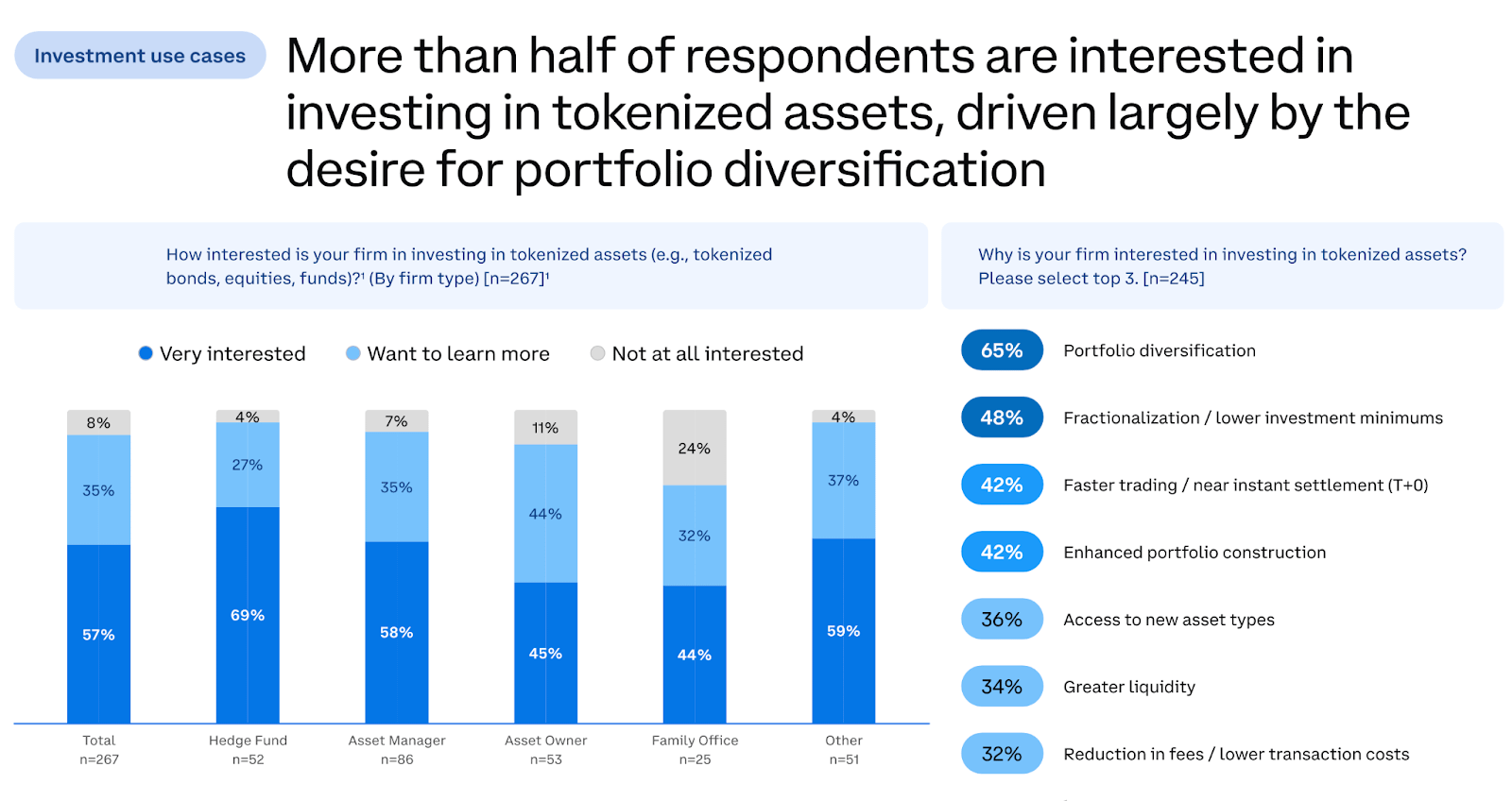

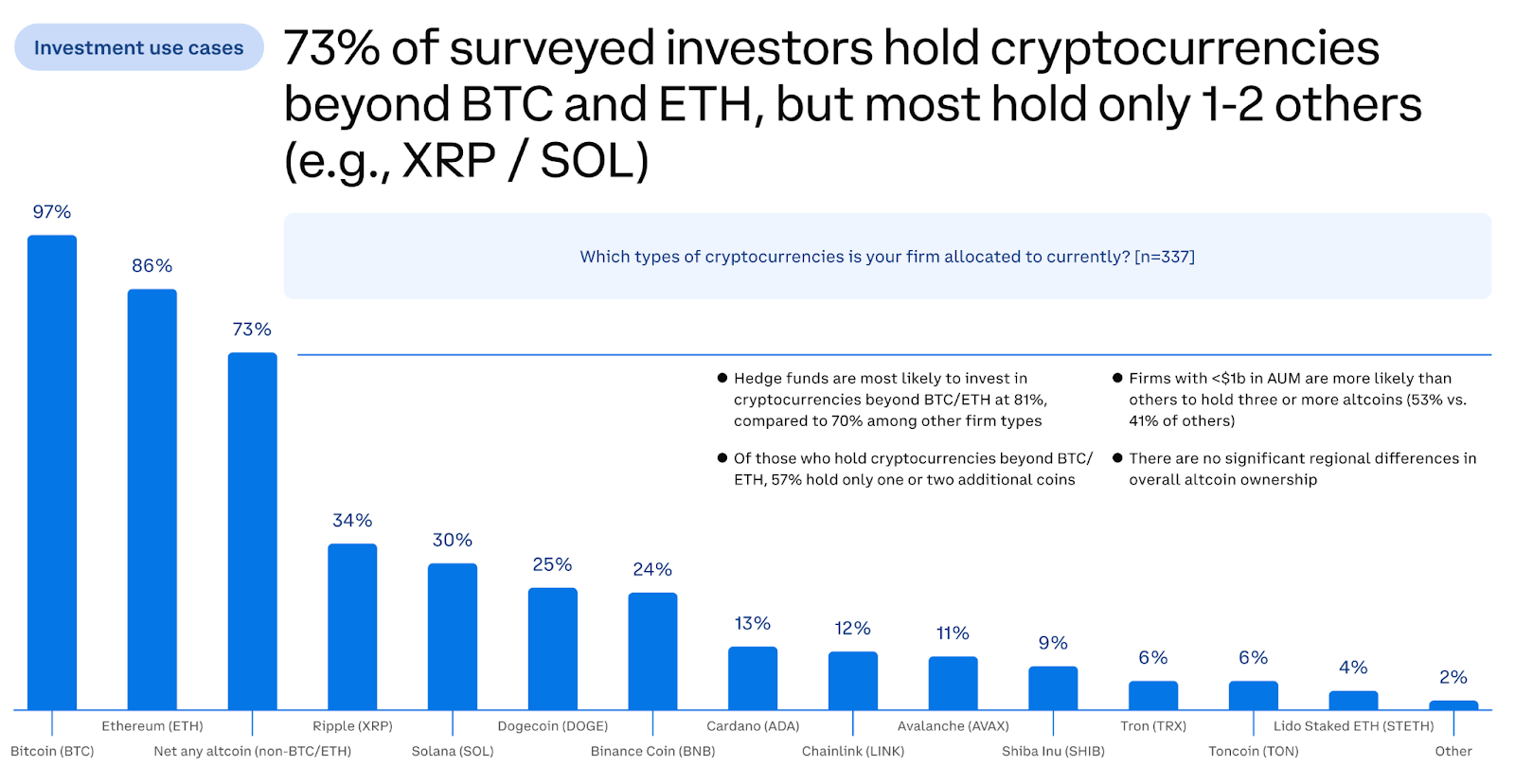

Tokenization & Multi-Chain Momentum

Tokenization is rapidly gaining traction, with 76% of firms planning investments in tokenized assets by 2026. Additionally, 73% of institutions hold altcoins beyond Bitcoin (BTC) and Ethereum (ETH), reflecting growing interest in multi-chain ecosystems that offer diverse yield opportunities.

Implications for Builders

The survey underscores several critical insights for developers and innovators:

- Infrastructure Scalability: As institutions increase their allocations to digital assets, robust infrastructure capable of supporting multi-chain operations will be essential.

- Yield Optimization: Platforms focusing on staking rewards and stablecoin interest can capitalize on institutional demand for reliable yield generation.

- DeFi Accessibility: Simplifying access to decentralized finance through compliance-ready solutions will be key to unlocking broader adoption.

- Tokenization Opportunities: Builders should prioritize tokenized asset offerings that align with institutional needs for portfolio diversification.

StakeKit’s Role in Empowering Institutional Growth

StakeKit is uniquely positioned to support this next phase of institutional adoption. With integrations across 75+ blockchains and access to over 1,000 yield opportunities, StakeKit provides scalable solutions tailored for wallets, DeFi applications, and staking providers targeting institutional clients.

Conclusion

The findings from the EY-Parthenon x Coinbase survey signal profound changes ahead for the digital asset industry. Institutions are driving the next wave of crypto adoption through increased staking activity, stablecoin integration, deeper engagement with DeFi platforms, and investments in tokenized assets. For builders ready to innovate with scalable infrastructure and yield-focused solutions, the future holds immense promise.

As we move forward into this transformative era for digital finance, StakeKit remains committed to empowering institutions with cutting-edge tools that unlock new opportunities across the blockchain ecosystem.

![Earn Digest #4 - [5th May to 9th May]](/content/images/size/w30/2025/05/earndigest4.png)

![Earn Digest #3 - [14th April to 24th April]](/content/images/size/w30/2025/05/earndigest3.png)